Table Of Content

1. Measuring Success with Customer Acquisition Cost

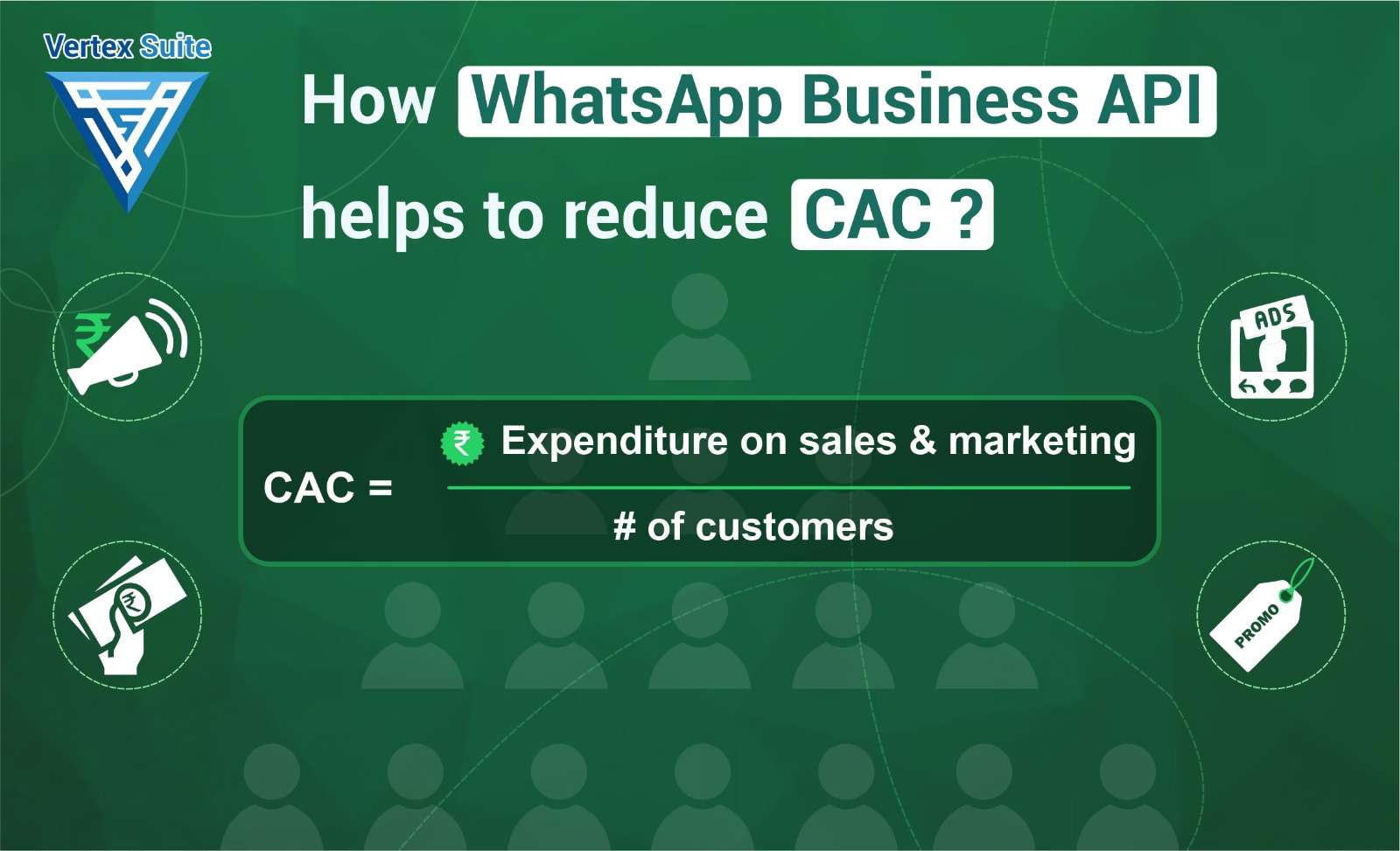

2. Understanding CAC

3. Reducing CAC with WhatsApp Business API

4. Measuring the Impact

Measuring Success with Customer Acquisition Cost

It's crucial for businesses to comprehend the Customer Acquisition Cost (CAC) to assess their potential profitability and the expenses associated with acquiring customers for their products or services. After a business has turned into a recognizable brand, developed high-quality products, formulated comprehensive marketing strategies, and is ready for market entry, it becomes imperative to navigate the entire business journey from start to maintain a realistic outlook when evaluating the company's growth and profitability.

Developing a product represents just the first step, and it is not a success yet. The most crucial phase involves acquiring customers and the expenses associated with this process. This is where the Customer Acquisition Cost (CAC) comes into play, providing a business with insights into its actual growth. It helps to determine how much a business invests in acquiring each customer, whether the investment is worthwhile, and whether if the customer's value to the company exceeds the average cost of acquiring a customer or not?, these metrics are essential for assessing the cost incurred to acquire each customer and the value they bring to the company.

CAC: A Key to Business Success

CAC assists the business in determining whether the right strategy has been chosen. It measures the effectiveness of all marketing efforts, which in turn marks the success of the business journey. CAC is not just about acquiring any customer but acquiring the right customer who is cost-effective for the business.

Let's explore how CAC serves as a vital tool for businesses and its relevance in estimating the money spent on acquiring a customer relative to the customer's purchase. It's generally advisable that a low CAC indicates business growth and the successful execution of marketing strategies. Conversely, a high CAC with customers not making substantial purchases raises a concern, which is a common in many businesses. Brands must focus on harnessing creative solutions to reduce costs and enhance efficiency to drive the enterprise toward new heights.

Understanding CAC

Customer Acquisition Cost (CAC) is a key metrics for businesses, used to measure the expenses incurred when acquiring new customers. It offers valuable insights into the company's marketing and sales performance. CAC is calculated by dividing the total cost of acquiring customers, which includes marketing and sales expenses, by the number of customers acquired within a specific period.

Let’s understand this with an example-

If a company spent ₹80,000 on sales and marketing in a particular month. In that same month, they acquired 100 new customers.

CAC = ₹80,000 / 100

CAC = ₹800 per customer

In this example, the Customer Acquisition Cost is ₹800 per customer. This means the company spent ₹800 on marketing and sales activities to acquire each of the 100 new customers during that month. A lower CAC indicates more cost-effective customer acquisition, which is typically desirable for businesses aiming to maximize profitability.

Higher CAC Example:

If there is a premium automobile manufacturer, XYZ Motors, invests heavily in advertising, exclusive showrooms, and high-end events to attract customers. In a year, they spend INR 8 crore on marketing and acquire 500 new customers.

CAC = ₹8,00,00,000 / 500 =₹1,60,000 per customer

In this case, XYZ Motors has a higher CAC of ₹1,60,000 per customer. This higher acquisition cost is justifiable because their products are high-end and have a significant profit margin. XYZ Motors targets a niche market of luxury car enthusiasts who are willing to pay a premium for their vehicles. The company prioritizes brand image which aligns with their customer base. They can afford a higher CAC because the lifetime value (LTV) of a customer, including maintenance and future purchases, is substantial.

Lower CAC Example:

Consider an e-commerce startup, specializing in affordable consumer electronics. They primarily rely on digital marketing, social media advertising, and email campaigns. Over a year, they spend ₹40, 00,000 on marketing and acquire 5,000 new customers.

CAC = ₹40, 00,000 / 5,000 = ₹800 per customer

In this example, electronic company has a lower CAC of ₹800 per customer. Their business model revolves around providing competitive prices and reaching a broad customer base. Due to the narrow profit margins associated with low-cost electronics, they need to keep their customer acquisition costs low to ensure profitability. They achieve this by implementing cost-effective marketing strategies and attracting a substantial number of price-conscious customers.

Analysis for Business:

It's essential for businesses to analyze their costs and segment them according to their pricing requirements for target markets, marketing, overhead expenses, and more. This segmentation facilitates a clear understanding of the Customer Acquisition Cost (CAC) tailored to their industry and objectives. Here are some key considerations:-

1. Always consider both high CAC and low CAC scenarios. In niche target markets, higher margins may justify a high CAC, whereas for lower-priced items, a low CAC is preferable.

2 . If a customer makes repeat purchases and remains loyal for a longer period, a higher CAC can be justified.

3. In today's highly competitive markets, minimizing CAC is vital for sustaining profitability.

4. Carefully select marketing strategies to strike a balance between product pricing, customer acquisition costs, and customer purchasing behavior.

By clearly understanding the distinction between higher and lower CAC, businesses can align their strategies with the market, customers, and their business goals.

Reducing CAC with WhatsApp Business API

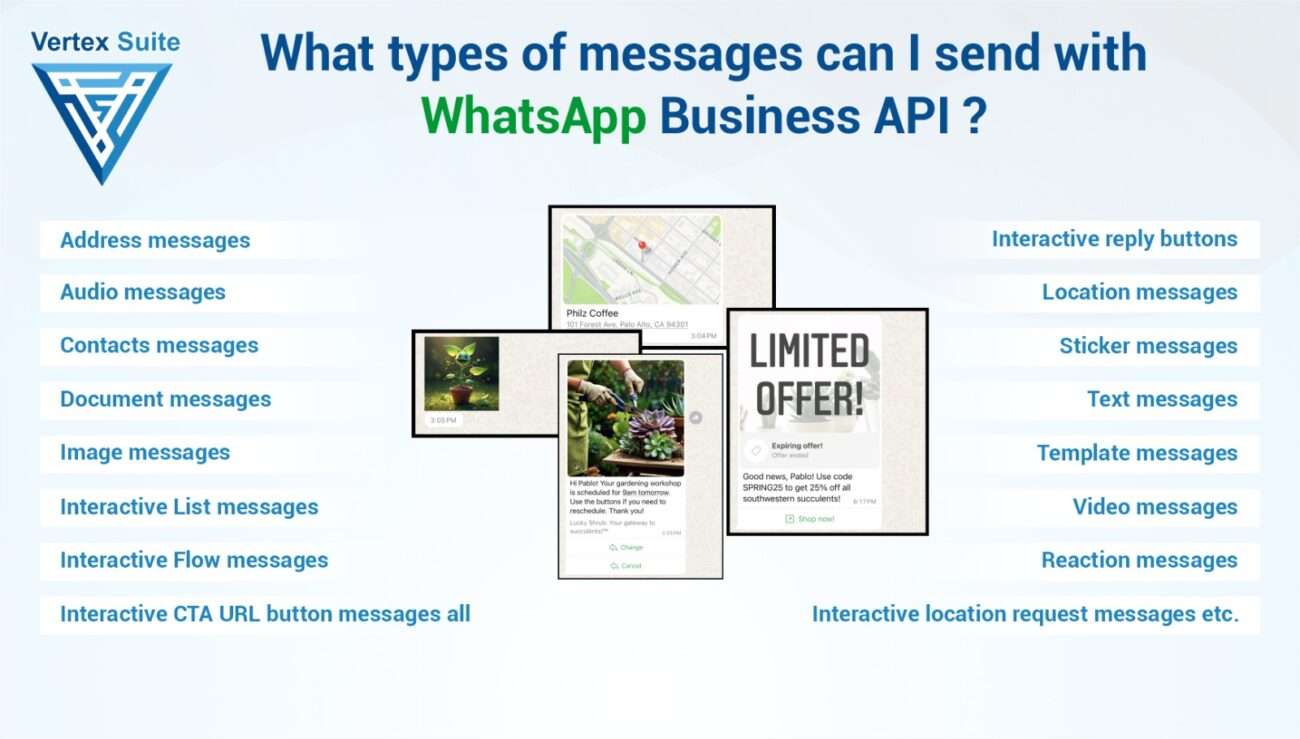

Here are some benefits of using the WhatsApp Business API to engage customers and reduce CAC:

1 .WhatsApp offers a direct and convenient way to reach out to customers without the constraints of social media or email checking.

2. WhatsApp ensures privacy with end-to-end encryption, creating a secure environment for all conversations, instilling trust in the brand.

3. Automation features reduce manual texts and communication, streamlining interactions.

4. Businesses can easily share images, videos, documents, and location data, simplifying the exchange of essential information with customers.

5. Product recommendations can be personalized based on a customer's browsing history and purchase patterns, increasing conversion rates and lowering the cost per acquisition.

6. The WhatsApp Business API allows for group messaging, international communications, and bulk messaging at a fraction of the cost.

7. Customers can reach out to businesses via WhatsApp, receiving real-time assistance, which reduces CAC by retaining existing customers and generating positive word-of-mouth referrals.

Case Studies

Case Study 1:

E-Commerce Success: A clothing retailer integrated the WhatsApp Business API to send personalized product recommendations to its customers. This led to a 20% increase in conversion rates, ultimately reducing their CAC.

Case Study 2:

Service Industry: A healthcare clinic used WhatsApp to send appointment reminders and collect feedback from patients. This streamlined their operations, reduced no-shows, and improved patient satisfaction, resulting in a 15% reduction in CAC.

Measuring the Impact

1. Tracking CAC Reduction

Here are some key metrics needs to address:

I. CPA:

It's essential to conduct preliminary calculations, as this makes it easier to determine the CAC linked to marketing campaigns.

II. Conversion analysis:

Analyze your conversion rates using data tools to compare conversions on WhatsApp with those on other platforms.

III. Customer Retention:

Evaluate the performance of customer support and its impact on customer engagement. If it enhances engagement, it signifies a reduction in CAC.

IV. Review Analysis-

Feedback is crucial for monitoring business performance. Positive feedback and reviews indicate a successful reduction in CAC.

2. Continuous Improvement

Improvement is an ongoing process, and to keep a check on CAC, businesses should utilize the following measures:

I. Data Evaluation:

Continuously analyze data metrics to monitor customer buying behavior and adapt marketing strategies accordingly.

II. Implement A/B Testing:

Conduct trials with different formats, contents, and mediums to identify the most effective approaches for engaging customers.

III. Compliance Check:

Stay updated with WhatsApp policies and compliances to ensure your business complies with all the rules aligned with WhatsApp's algorithm.

IV. Workforce Training:

Always provide training to your team before they handle customer queries, as unpreparedness can negatively impact the business.

By incorporating these measurement techniques and continually optimizing your strategies, you can harness the full potential of the WhatsApp Business API to reduce your Customer Acquisition Cost (CAC) and enhance overall business efficiency.

One thought on “How WhatsApp Business API helps to reduce CAC (Customer Acquisition Cost)”

Comments are closed.