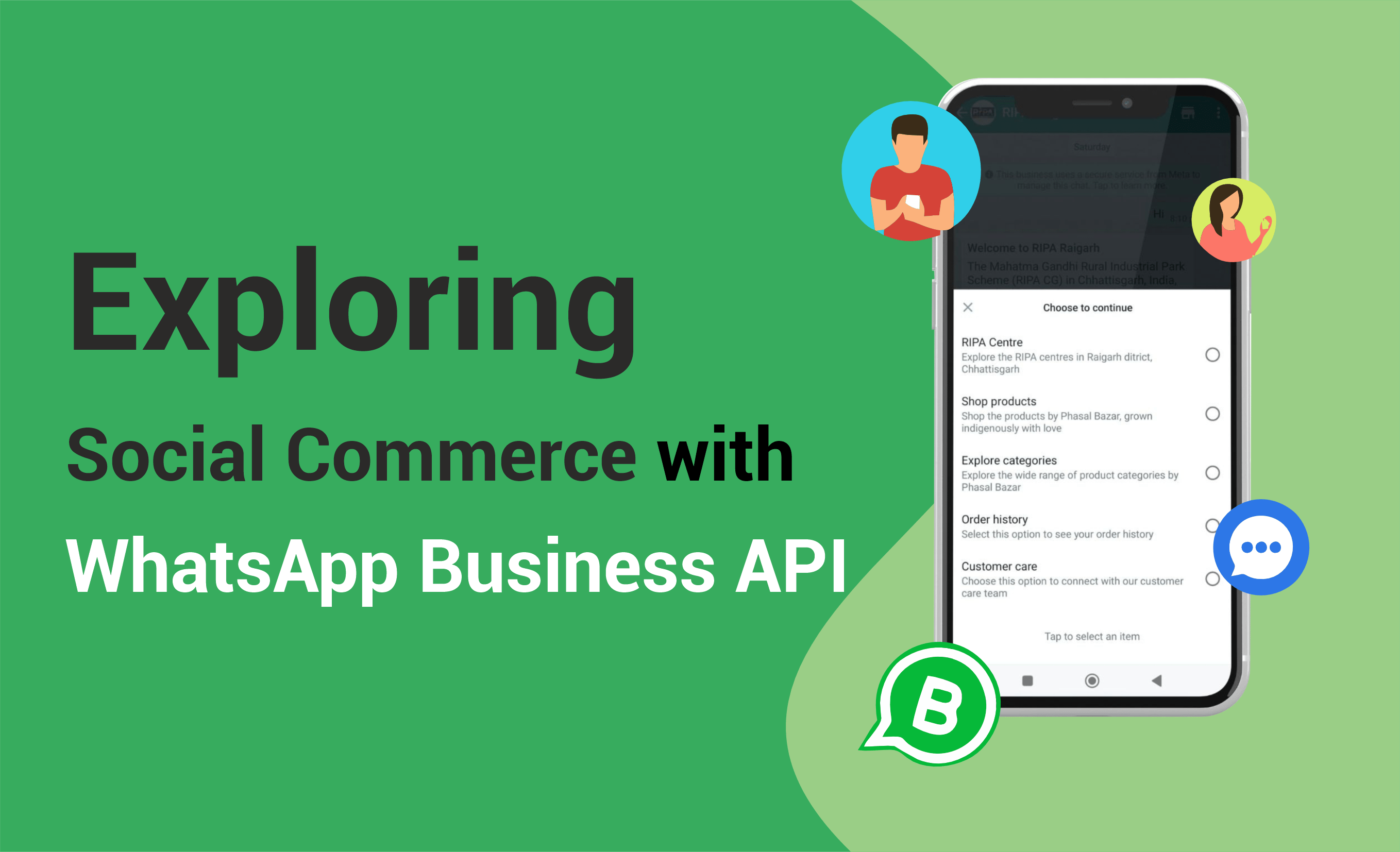

In this modern world, along with many new technologies, communication technology is also developing rapidly. The main purpose of these advancements is to save time for citizens and enable them to access services more easily. Here, we are talking about WhatsApp as part of communication technology, a product used globally. WhatsApp has a 70 to 80% higher open rate than other communication channels, making it an excellent platform for businesses to grow their services.

Businesses can now send personalized messages to customers, helping them boost sales or services. Additionally, businesses can create chatbots and take orders for their products or services directly through WhatsApp. This platform enables businesses to work with better marketing tools.

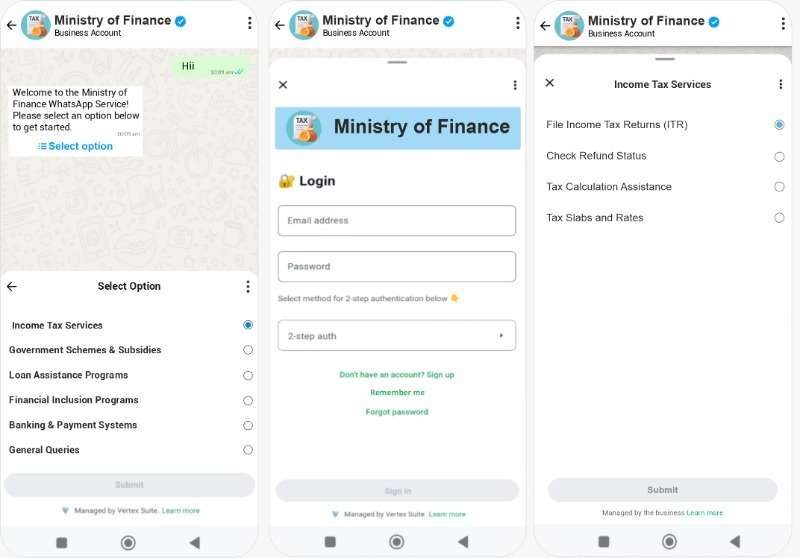

While this highlights WhatsApp's role in the industry, I want to shift focus to the government sector, where it can be equally beneficial. Specifically, I’d like to talk about finance government departments. Using WhatsApp, taxpayers can easily access services like paying Income Tax online, applying for a PAN Card, applying for a TAN Card, using the Income Tax Calculator, registering for GST online, and much more. All of these tasks can be easily managed via WhatsApp.

We will explain this through a proper chat flow, so that government departments can understand that, in addition to providing services through websites and apps, they can also offer these services via WhatsApp, enhancing convenience and delivering better services to consumers.

1. Multilingual Support

1. Multilingual Support

The chat flow begins with a language selection to cater to users from different regions:

Welcome Message:

Welcome to the Ministry of Finance! Please select your preferred language:

EnglishHindi[Regional Language]Pay Income Tax Online

The process for paying income tax via WhatsApp includes secure verification, easy form filling, and payment options:

1. Identity Verification:

-Enter PAN/TAN number.

-Enter mobile number for OTP verification.

-OTP is sent; upon successful verification, the user can proceed.

2. Confirm PAN/TAN Details:

- Users confirm personal details associated with their PAN/TAN.

3. Select Payment Type:

- Choose from 'Income Tax,' 'Equalisation Levy,' 'Fee/Other Payments.'

4. Assessment Year and Payment Type:

- Select ‘Assessment Year’ and ‘Type of Payment.’

5. Enter Tax Amount:

- Input the exact amount for tax, surcharge, cess, etc.

6. Verify and Pay:

- All the details (PAN, tax amount, etc.) will be displayed for verification.

- Select payment mode: UPI, Net Banking, Credit/Debit Card, E-Wallets (e.g., Paytm, Google Pay).

- Complete the payment.

7. Generate Receipt:

- Upon successful payment, a digital receipt will be displayed and sent to the user's email.

8. Feedback Request:

- After payment, the user is asked to rate their experience and provide feedback.

Apply for PAN Card Online

Users can apply for a new PAN card or update existing PAN details with ease:

1. Select Application Type:

- Choose between:

- Apply for PAN (Indian Citizen)

- Apply for PAN (Foreign Citizen)

- Change PAN Data

2. Select Category:

- Choose your category:

- Individual

- Firm

- Trust

- LLP

- Government

3. Enter Personal Details:

- Fill in First Name, Middle Name, Last Name, Date of Birth, Gender, Mobile Number, Email, and Aadhaar Number.

4. Upload Documents:

- Upload Aadhaar Card, Photo, and Signature.

5. Income Details:

- Select the type of income:

- Salary

- Business Income

- Income from House Property

- No Income

6. Address Information:

- Fill in the complete address (State, District, PIN code).

7. Submit Application:

- Submit the form, and track the status through WhatsApp.

Apply for TAN Card Online

For companies, firms, or individuals looking to apply for a TAN card, the process is straightforward:

1. Select Application Type:

- Choose from:

- New TAN Application

- TAN Change/Correction

2. Select Category:

- Choose between:

- Company

- Hindu Undivided Family (HUF)

- Government Body

- Firm

3. Enter Company Details:

- Fill in required fields such as Area Code, AO Type, Range Code, AO Number, Company Name, Address, PAN, etc.

4. Payment

Details:

- Select the mode of payment and complete the transaction.

5. Track Application:

- Users can track the status of their TAN application via WhatsApp by entering their acknowledgment number.

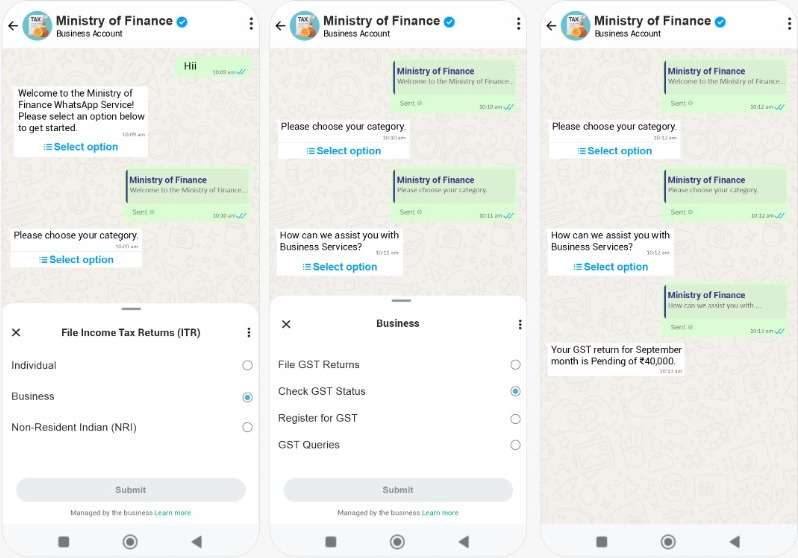

Check Status of Tax Refunds

Users can quickly check their tax refund status via WhatsApp:

1. Enter PAN & Year:

- Input PAN and select the financial year.

2. Verify Identity:

- OTP verification to confirm identity.

3. View Refund Status:

- Receive real-time status of the tax refund.

Income Tax Calculator

To calculate income tax, users can fill in their details and get a result instantly:

1. Select Assessment Year

2. Select Taxpayer Type (Individual, Company, LLP, etc.)

3. Enter Net Taxable Income

4 View Total Tax Liability

- Users will receive a detailed breakdown of their tax liability, including education cess, surcharge, etc.

Register for GST Online

The GST registration process can be started and completed within WhatsApp:

1. Select Category:

- Taxpayer, Tax Deductor, E-Commerce Operator, etc.

2. Enter Business Details:

- Fill in the PAN, business name, address, and other details.

3. Document Upload:

- Upload PAN, Aadhaar, and other supporting documents.

4. Submit & Track:

- Complete the registration and receive a tracking ID for status updates.

Grievance Redressal and Feedback

To ensure accountability and service improvement, users can file grievances or give feedback:

1. File Complaint:

- Users can submit complaints regarding tax refunds, payment issues, or PAN/TAN services.

2. Track Complaint:

- Enter complaint ID to receive real-time updates on the status.

3. Submit Feedback:

- Rate services and share open-ended feedback for improvement.

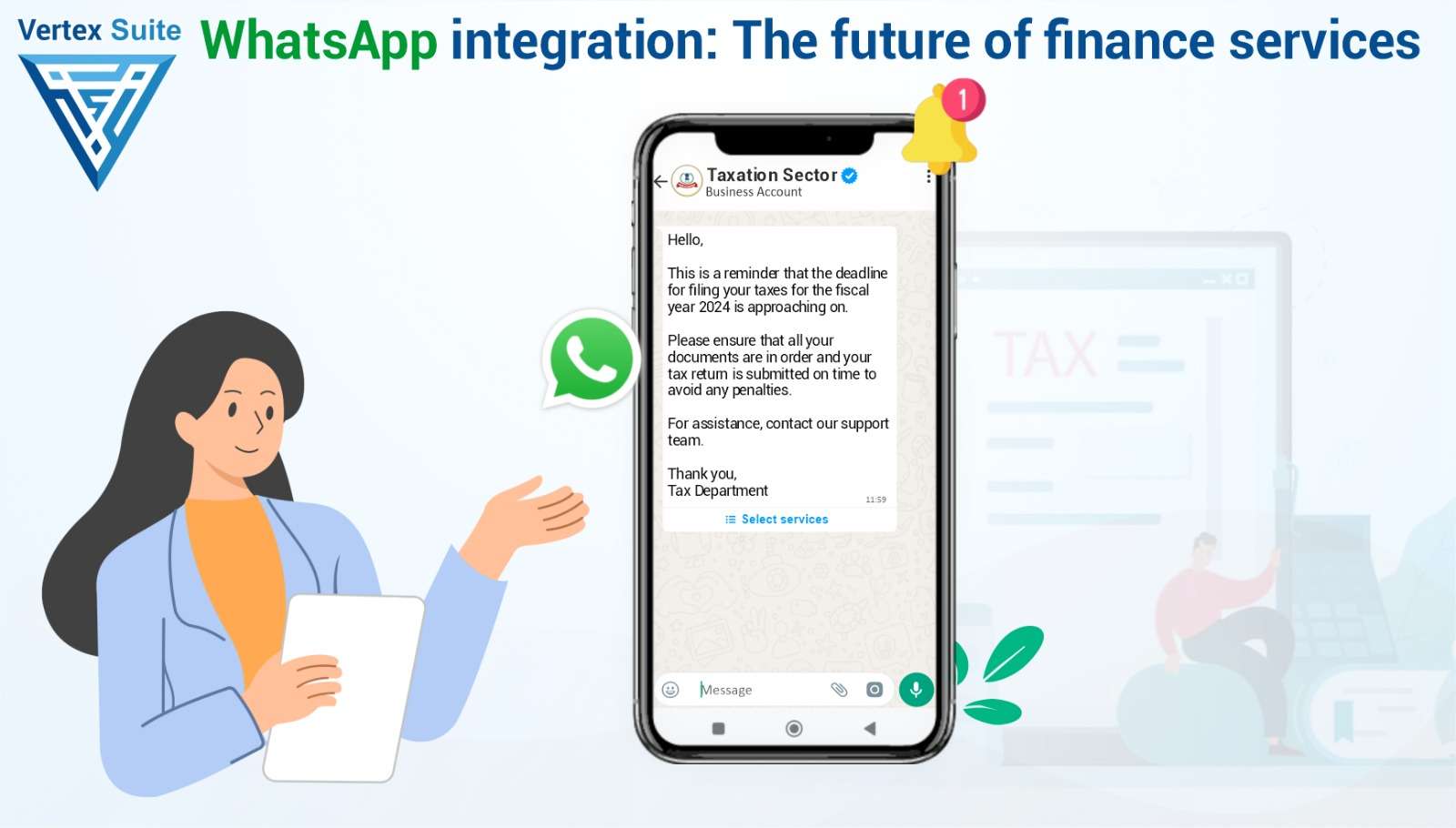

Notifications and Alerts

Users can subscribe to automatic updates and notifications:

- Payment Deadlines

- Tax Law Changes

- New Government Announcements

Example: You have a pending tax payment due on [Date]. Please pay to avoid penalties.

Video Tutorials and Help Guides

Users can access explainer videos or chatbots to help them with complex tasks:

Example: Watch a 2-minute video on how to file income tax online.

WhatsApp chatflow can help the government finance ministry to access its services through the above chatflow. Through this chatflow, the finance ministry not only makes its services easily accessible but also saves the time of the citizens which is a unique option. From tax payments, PAN and TAN applications to real-time updates on refunds and complaints, this flow is designed for ease of use, transparency and accessibility. Additional features like document vault, explanatory videos, complaint tracking and notifications make it even more user-friendly. These changes ensure that citizens get a seamless, efficient and transparent experience when connecting to this unique service of WhatsApp Business API.